Why OnestPay Is Better Than Traditional Credit Cards

Credit Cards Still Dominate U.S. Spending — But at What Cost?

Key Highlights

- OnestPay™ vs Traditional Credit Cards

- APR Traps and Debt Explained

- OnestPay™ as the Responsible Alternative

- Reward-Based Ecosystem

Credit Cards Still Dominate U.S. Spending — But at What Cost?

Credit cards remain one of the most popular payment methods in the United States. The Federal Reserve roughly estimates 32% of monthly payments in the U.S. are made using credit cards — highlighting their strong presence in everyday transactions.

While digital payments and direct bank methods are rising, credit cards continue to hold a dominant position due to convenience, wide acceptance, and embedded reward systems. But behind that ease are hidden fees & costs that most users overlook.

From MasterCard and Visa to American Express and Discover, consumers have an array of options, each offering rewards such as airline miles, hotel perks, and cashback bonuses. At first glance, it seems like a win-win. It’s quick, easy, and universally accepted. Yet, those rewards often mask hidden credit card fees costing you money, which many users realize only after getting trapped in high-interest cycles.

But behind this convenience lies a pattern of overspending and long-term debt — a financial habit that millions of Americans struggle to break. The APR traps & debt that stem from revolving balances are the real cost of this so-called convenience.

How Many Credit Cards Do Americans Really Have?

The average American owns three credit card accounts. In total, about 191 million adults in the U.S. have at least one credit card, while half of all Americans maintain two or more. Nearly 13% of cardholders juggle five or more cards, underscoring just how deeply embedded this financial tool has become in American life.

It’s a statistic that reflects dependency — and one reason why it’s vital to know how to avoid the credit card debt trap. Choosing the best credit card alternative with no fees can play a huge role in improving financial wellness.

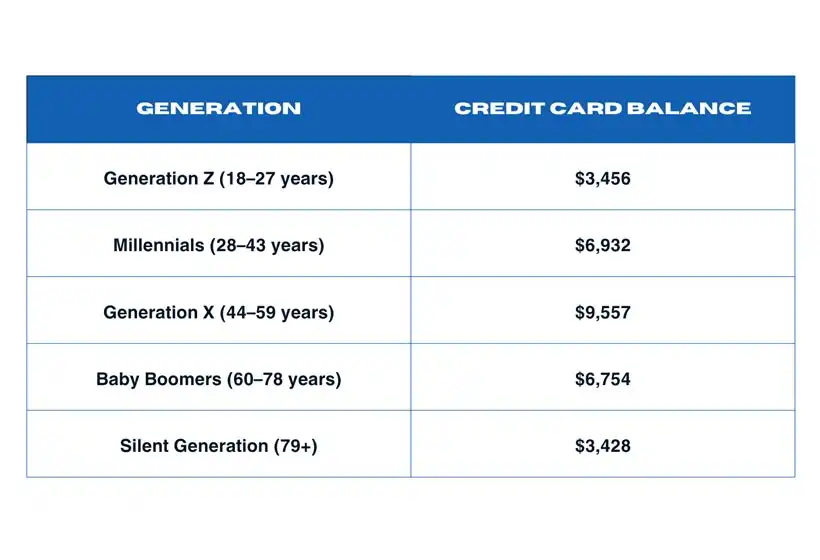

Average Credit Card Debt by Age

As of 2025, Americans collectively hold over 600 million open credit card accounts, according to the Federal Reserve Bank of New York. Yet debt levels vary widely by generation.

Experian’s 2024 report highlights the following average balances:

(Source: Forbes Advisor)

The report also shows the average number of cards per person:

- Silent Generation: 1 credit card

- Baby Boomers: 4 credit cards

- Generation X: 4 credit cards

- Millennials: 4 credit cards

- Generation Z: 2.2 credit cards

The Illusion of Freedom — and the Debt Trap Beneath It

Swiping a credit card provides instant gratification — the freedom to buy now and worry later. For consumers who pay off balances in full each month, this system works efficiently. They earn rewards, enjoy convenience, and build credit.

However, for millions who carry balances month to month, the story is far different. Interest rates on unpaid balances can climb as high as 25–30%, turning simple purchases into compounding liabilities.

Missed payments lead to:

- Lower credit scores

- Blocked credit card accounts after 6 months of non-payment

- Potential legal action for long-term defaults

- High compounding interest on overdue balances — sometimes exceeding the original amount owed

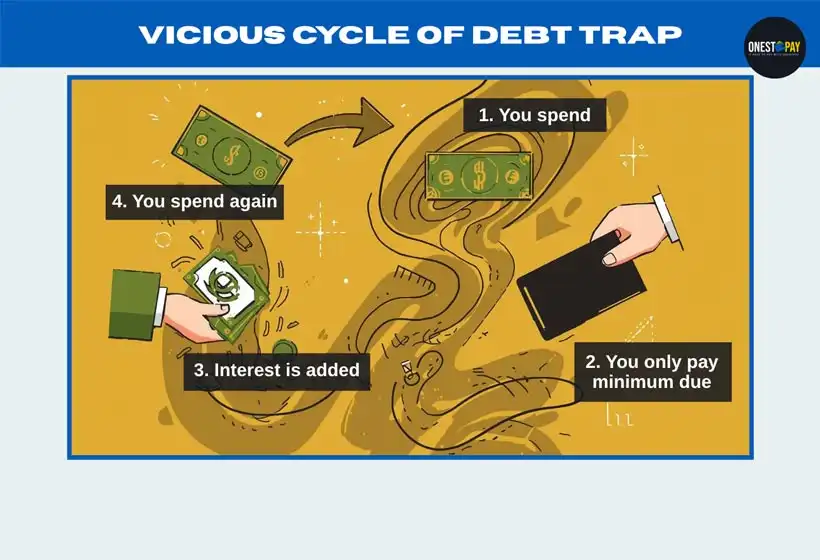

The APR Trap: How Revolving Debt Works

Many Americans fall into the “minimum payment trap”, where unpaid balances keep accumulating interest each month. Here’s how the cycle unfolds:

- You spend.

- You pay only the minimum due.

- Interest is added.

- You spend again.

This revolving pattern locks users in a permanent interest cycle, often referred to as the APR trap. Choosing the best credit card alternative with no fees can break this cycle and promote responsible spending dashboard habits.

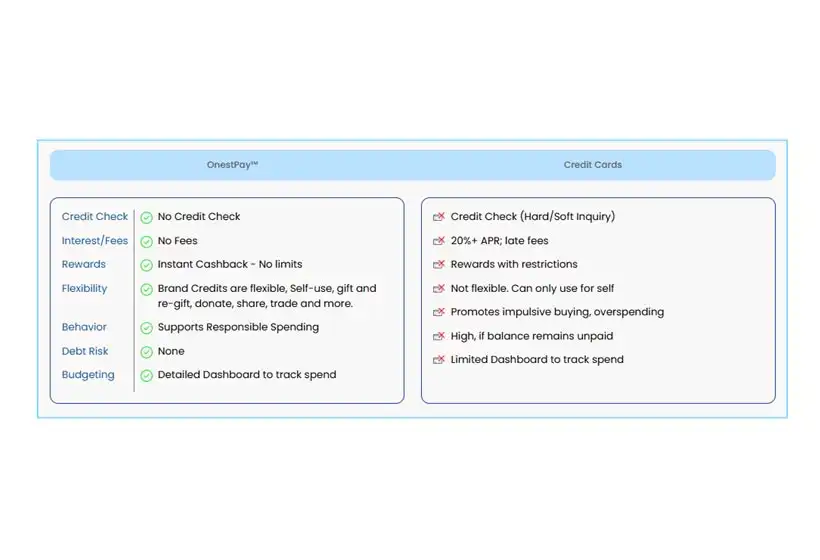

OnestPay™: Smarter, Debt-Free Alternative

So, What is OnestPay™?

OnestPay™ is built on a simple yet powerful idea — shop smart, spend free.

As one of the popular credit card alternatives, a digital payment platform with no annual fee, OnestPay™ eliminates the need to borrow altogether. It’s the best credit card alternative with no fees, making it a safer way to spend than a credit card.

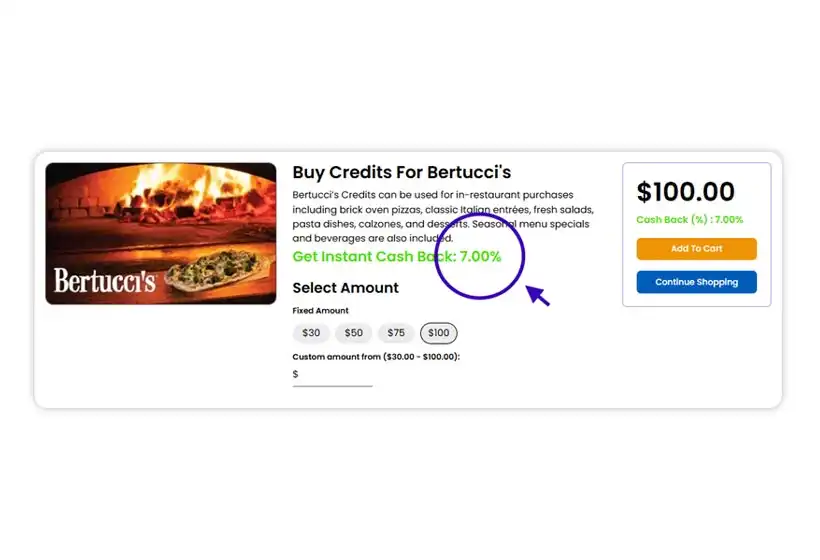

OnestPay™ instead of revolving debt, operates on a prepaid model — users prepay their favorite merchants like Target, Walmart, or Macy’s by purchasing merchant credits in advance.

For example, when you buy credits from Target through OnestPay™, you not only lock in value but also earn cashback instantly.

Typical cashback ranges from:

- 1–2% on essentials like groceries

- Up to 5–15% on dining, fashion, and electronics

So, every time you shop through OnestPay™, you open up a bigger reward umbrella — earning meaningful money back from the places you already love to shop.

The OnestPay™ Advantage

Think of it as a prepaid digital voucher that earns you instant cashback and encourages financial wellness by helping you track spend and save money.

This structure ensures that users spend only what they have without the hidden credit card fees costing them money, while still enjoying the benefits of modern digital payments.

Getting Started With OnestPay™

Getting started is easy — simply sign up, fill in your basic details, and your OnestPay™ account is ready to use.

- Step 1 – First, you sign up and create a secure OnestPay digital wallet.

- Step 2 – OnestPay™ lets you connect directly to your bank account.

- Step 3 – You add funds from your account. There’s no credit check and no risk to credit history.

- Step 4 – Voila! Now you can spend, gift, share, or swap credits effortlessly — all from one dashboard.

Evolution in Flexible Spending

Your needs evolve.

OnestPay™ evolves with you — offering true financial wellness through responsible spending dashboard tools.

For instance, if you buy $100 in Target credits but later prefer electronics, you can swap Target credits for Best Buy credits within the marketplace.

This means your credits are never stuck; you can trade, gift, or swap them as your priorities change — with no hidden credit card annual fee confusion.

With OnestPay™, you gain true financial flexibility — not just in spending, but also in how you share and manage your funds.

An Onest Takeaway!

Credit cards may have defined an era of convenience — but they also defined an era of APR traps & debt.

OnestPay™ represents the next evolution of responsible digital finance: one that empowers users, eliminates interest, and rewards discipline.

By allowing you to pay only with what you have — and still enjoy cashback, flexibility, and security — OnestPay™ is redefining what financial freedom really means. It’s time to break free from hidden credit card fees costing you money.

Embrace the next credit card alternative with no fees — OnestPay™.