Why OnestPay Is Better Than Debit Cards?

Hidden Cost of Debit Cards – Flip the Script on Spending

Highlights

- Hidden Cost of Debit Cards – Flip the Script on Spending

- Earn More on Every Dollar

- How OnestPayTM Works

- Financial Freedom- Let your money work as hard as you do

Around 30% of American households use debit cards for their monthly payments (Federal Reserve reports, 2025). And, it’s clear by now, that debit cards have become a trusted financial tool for millions.

They’re simple, direct, and help you stay within budget. When you use a debit card, you’re essentially spending your own money — no credit checks, no borrowing. You’re keeping your spending in check, avoiding debt, and managing your finances responsibly.

That’s admirable. In fact, debit cards are part of the everyday American wallet — right next to cash and credit cards — helping households plan their monthly budgets without overextending themselves.

But here’s the big question:

Are you getting rewarded for your financial discipline?

If you’ve ever thought, “My bank debit card has no rewards,” you’re not alone. That’s one of the key disadvantages of debit cards many consumers overlook.

In our upcoming section on OnestPay Vs Debit Card, we’ll explore how OnestPay™ redefines this equation — turning responsible spending into real rewards.

The Hidden Cost of Playing It Safe – with Debit Cards

You might think keeping your money in a bank checking account is the smart and safe move — and in many ways, it is. But when you look closely, safety comes with hidden costs and almost no real return.

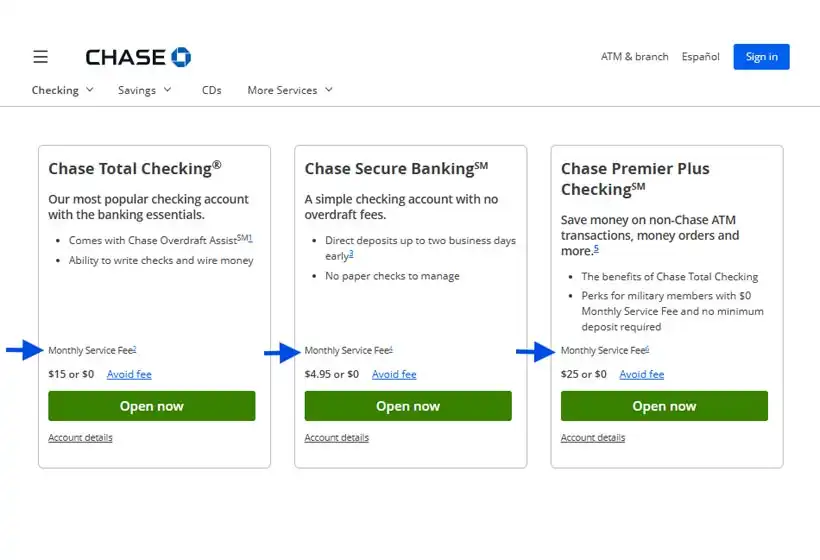

Take Chase’s own checking options for example:

- Chase Secure Banking℠ charges a $4.95 monthly service fee.

- Chase Total Checking® has a $15 monthly fee (unless you meet certain conditions to avoid it).

Chase Premier Plus Checking℠ comes with a $25 monthly fee, again, waived only if specific balance or deposit thresholds are maintained.

That means, even before you’ve earned anything, you’re already paying to access your own money.

And what about the earnings on your balance?

Chase’s checking accounts, like most traditional banks, offer no interest or an almost negligible APY — typically around 0.01% annually.

Let’s put that into perspective:

- Keep $100 in a Chase checking account → you’ll earn just $0.01 in an entire year.

Your money sits idle, while the bank invests your deposits elsewhere — generating profits that never find their way back to you.

That’s where OnestPay™ changes the equation.

OnestPay™: A Smarter Way to Spend and Earn

Now, compare that with OnestPay™, which flips the script on how you manage and grow your money.

With OnestPay™, there are no monthly service fees, no minimum balance requirements, and no hidden costs.

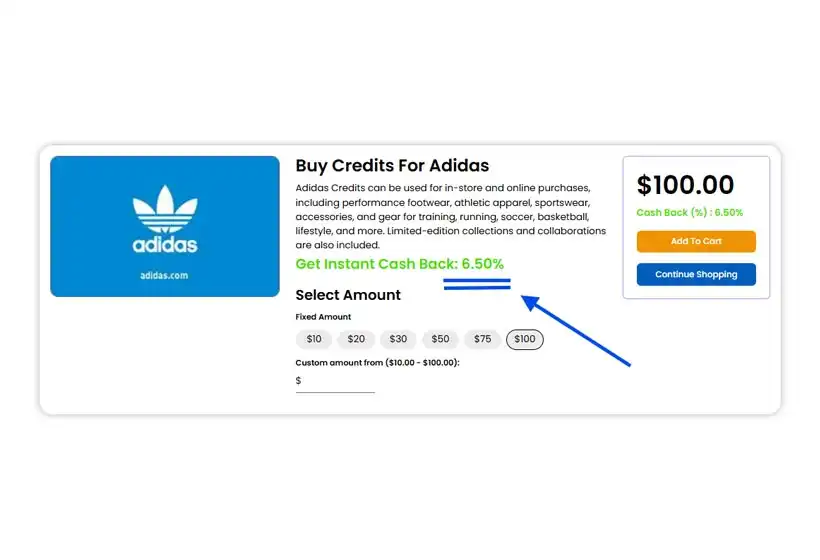

Instead, you’re rewarded for how you spend. When you use your OnestPay™ digital wallet to prepay trusted merchants like Adidas, Macy’s, or Olive Garden, you instantly earn cashback rewards — sometimes as high as 6.5% or more, depending on merchant offers.

Here’s a simple example:

- Keep $100 in a traditional Chase checking account → earn $0.01 in a year.

- Keep $100 with OnestPay™ merchants → earn up to $6.50 in cashback every time you buy, that’s almost $60 in cashback credits annually.

That’s not just better — that’s transformative.

This model is built on OnestPay™’s “Save Now, Buy Later” philosophy. You prepay at the brands you love, and your loyalty is rewarded immediately. For example, a $100 purchase at Adidas can give you an instant 6.5% cashback, turning your spending into smart saving.

Unlike a checking account that costs you to maintain, OnestPay™ empowers you to save, earn, and spend — all within one seamless digital wallet experience.

How Does OnestPay™ Work?

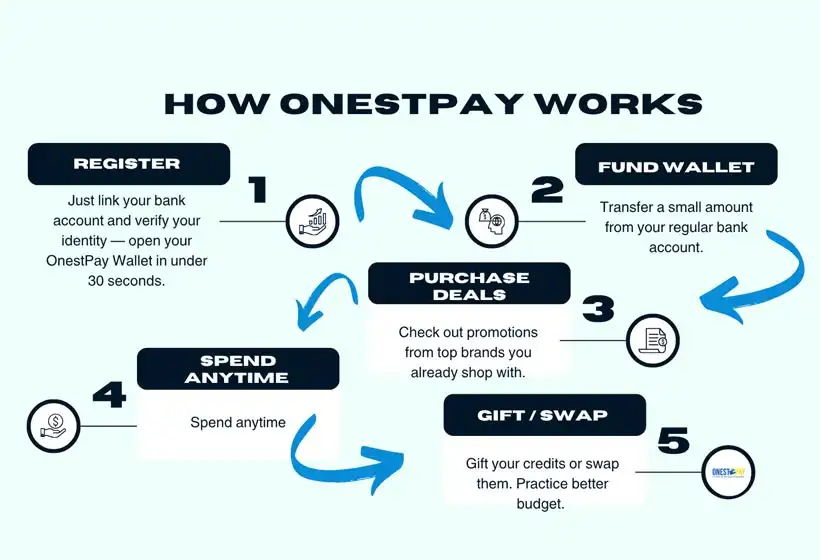

Getting started with OnestPay™ is simple:

- Register and open your OnestPay™ Wallet

- No credit checks, no complicated reviews.

- Just link your bank account and verify your identity — done in under 30 seconds.

- Fund your wallet

- Transfer a small amount from your regular bank account.

- Purchase merchant deals and earn cashback

- Check out promotions from top brands you already shop with.

- For instance, prepay $100 to Target, receive $5 in bonus value.

- Spend anytime

- Spend anytime you want at stores or online

- Gift or swap

- Gift your credits or swap them

These credits are digital, transferable, and versatile — you can send them to family, use them for gifting, or even save them toward bigger purchases. It’s a digital-first, cash-equivalent model that rewards responsible spending — the very principle that debit card users value.

Shift in Consumer Finance

OnestPay’s Financial Empowerment

Michael Walters in particular notes in The Atlantic how America is undergoing a “debit-card rebellion.” More consumers are choosing debit cards to avoid revolving debt — yet, paradoxically, they’re settling for less security, less flexibility, and zero growth.

Many users even admit, “My bank debit card has no rewards,” highlighting one of the key disadvantages of debit cards in today’s evolving financial landscape.

That’s the gap OnestPay™ fills.

In the debate of OnestPay Vs Debit Card, OnestPay™ doesn’t just help you save — it reshapes how you think about liquidity and value.

- 24/7 accessibility: Your wallet is always available, wherever you are.

- No hidden fees: What you see is what you get.

- No expiry: Your credits remain valid — unlike limited-time offers from banks or cards.

- Transferable value: Gift or share your balance digitally with loved ones.

- Real rewards: Earn genuine cashback and bonus credits, not fractional interest points.

This flexibility gives you full control over your spending — combining the practicality of money management apps with the innovation of alternatives to traditional banking.

The Onest Takeaway

Debit cards are great for responsible spending — but they don’t reward your good habits.

That’s one of the biggest disadvantages of debit cards in today’s financial banking ecosystem.

So, ask yourself:

Would you rather keep your funds idle in a bank earning 0.01% — or put them to work with trusted merchants, earning up to 20x more in rewards?

In the conversation of OnestPay Vs Debit Card, the difference is clear — OnestPay™ empowers you to save while you spend, transforming everyday transactions into long-term value.

It’s time to make your money work as hard as you do.