Essential User Instructions: Wallet, Reports & Credit Rules

Welcome to your ultimate walkthrough of the OnestPay™ experience.

If you’ve been wondering how to add funds, read reports, gift responsibly, or manage your bank accounts—you’ve landed in the right place. This guide is for every user who wants a simple, step-by-step guide to make the most of OnestPay’s™ smart, secure, and socially powered wallet system.

Whether you’re just starting or you’ve been using OnestPay™ for a while, this guide will take you through the essentials—from navigating your Wallet to understanding the logic behind Credit Rules.

Let’s dive in!

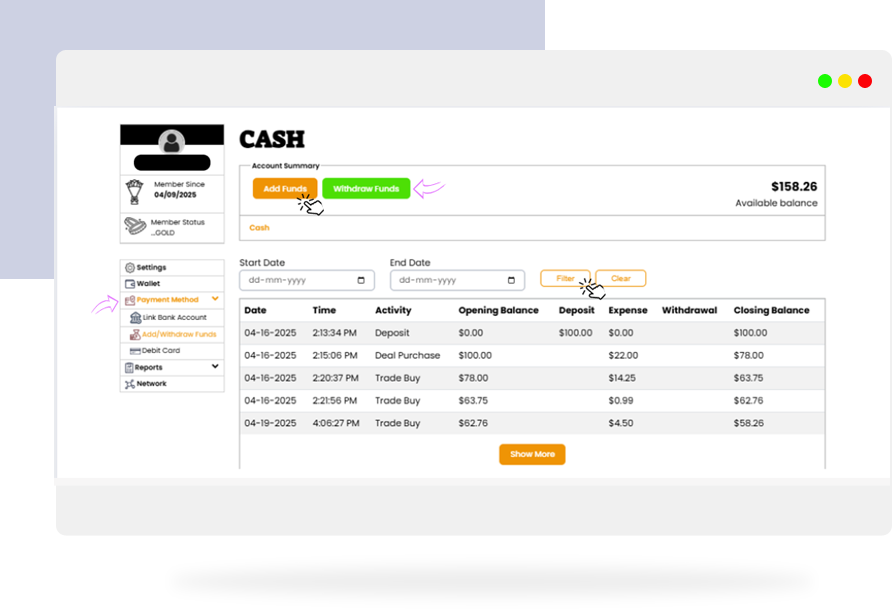

01 Add Funds Using Today’s Date

Get Started in 3 Easy Clicks

Whether you’re prepping for a purchase or just want to load your wallet for future use, adding funds is the first step to unlocking OnestPay’s™ full potential. Here’s how:

- Go to the Balance page

- Choose your Payment Method (Primary or Secondary bank account). Go to Payment Method Settings

- Enter the amount, select the date “you can use Today’s Date” as the transaction time for an immediate deposit, and hit Add Funds

- Use your OnestPay™ Debit Card or linked bank account to confirm.

Tip: Make sure your bank account is linked for faster transactions. Instant deposits = instant savings..

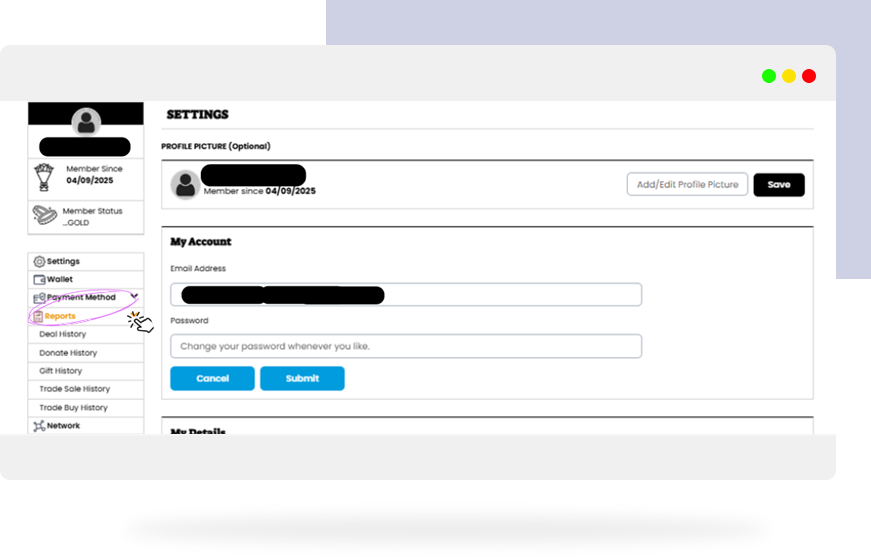

02 Reports You’ll Actually Use: Viewing & Understanding Transactions

Tired of complicated statements? OnestPay™ makes reports refreshingly simple.

Track Everything — From Orders to Trade History

The Reports Dashboard gives you full visibility into every credit move you make. Here’s how to stay on top of your spending and earning:

Go to:

- Order Details — for all credit purchases

- Donate Order Details — to track your charity impact

- Gift Order Details — see all gifted credits

- Trade Sale History — view credits you’ve sold

- Trade Buy History — check purchased credits from other users

Use Filters to narrow down by date, type, and amount — or download reports for record-keeping.

3. Credit Rules 101: Gifting, Donating & The $1 Rule

At OnestPay™, generosity comes with responsibility.

Key Rule:

➡️ You must always maintain a $1 minimum in your wallet before gifting or donating.

Why?

It’s a security safeguard — ensuring you always have access to basic features and wallet activity post-transaction.

Gifting Rules:

- Visit the Gift Page

- Send any amount instantly, with zero fees

- Add a personal message

- Receiver doesn’t need an account—they’ll be prompted to create one

Donating Rules:

- Go to Donate Credits

- Select a verified charity

- Send as little or as much as you want

- Receive a digital donation receipt for tax purposes

All donations and gifts are secured with Multi-Factor Authentication.

4. Why Gifting/Donation Rules Don’t Apply to Trading

Trading is handled differently—no $1 minimum balance required here.

When you’re trading credits, you’re in the open marketplace — the $1 minimum balance doesn’t apply here.

To trade your Merchant Credits:

- Visit Trade Credits

- Buy or sell merchant credits with peers

- Set your own prices

- Execute fast, secure transactions

You can also bundle credits from multiple merchants in one listing.

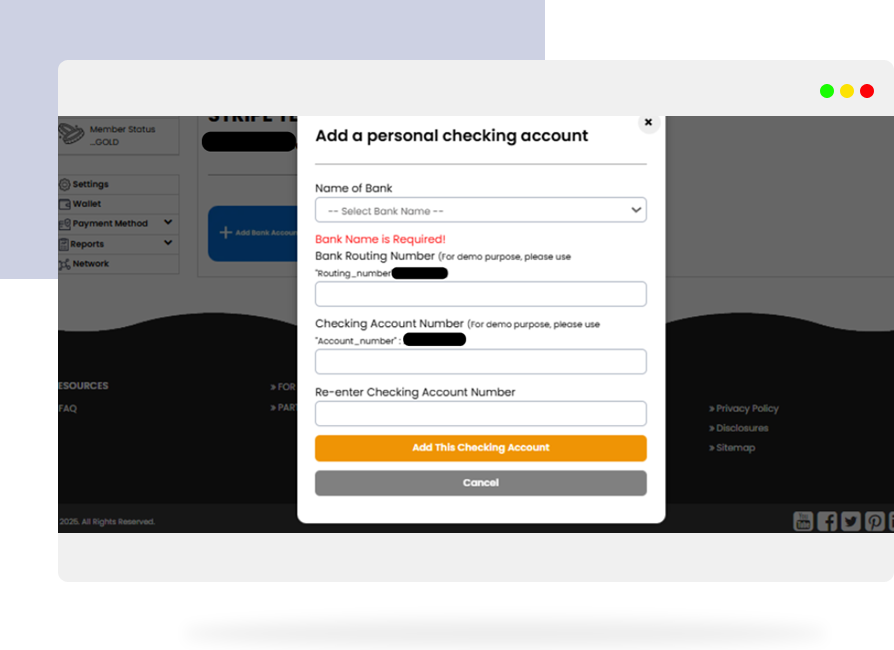

05 Managing Multiple Bank Accounts: Primary vs. Secondary

Control where your money comes from and goes. You can link more than one bank account to your OnestPay™ profile, but here’s how to stay in control: Manage Accounts

Linking Accounts:

- Head over to Payment Method Settings

- Add Primary (default) and Secondary bank accounts

What’s the Difference?

- Primary: Used for default deposits, withdrawals & purchases

- Secondary: Acts as backup if the Primary account has issues

You can switch anytime between accounts for different transactions. Seamless. Flexible. Smart.

Security Comes First

From Multi-Factor Authentication (MFA) to data encryption, your Wallet and transactions are protected every step of the way. Bonus: FDIC insurance applies to your cash balances (not Merchant or Bonus Credits).

Quick Recap – Your Smart Usage Checklist

- Add Funds via Wallet using today’s date to take advantage of flash deals.

- View all order types in one report dashboard

- Follow the $1 rule when gifting or donating

- Trade freely without donation rules

- Set Primary/Secondary bank accounts for flexibility

Take the Next Step & Pay Smart with OnestPay

OnestPay™ isn’t just another wallet—it’s your financial co-pilot.

Whether you’re adding funds, gifting friends, trading for value, or supporting causes, OnestPay™ gives you full control, with no hidden fees and maximum transparency.

So go ahead—log in, explore, and make your Wallet work smarter for you.

Start now at OnestPay.com