Can OnestPay Beat Traditional Gift Cards?

Gift cards have long been a holiday favorite — convenient, thoughtful, and easy to send. According to Forbes (Nov 2024), the U.S. gift card market is valued at a staggering $200 billion, with nearly two-thirds of Americans receiving at least one gift card in 2023.

Key Highlights

- Popularity of Gift Cards

- Hidden Drawback of Traditional Gift Cards

- Smarter Alternative: Save Now, Buy Later

- How To Gift Through OnestPay

Gift cards have long been a holiday favorite — convenient, thoughtful, and easy to send. According to Forbes (Nov 2024), the U.S. gift card market is valued at a staggering $200 billion, with nearly two-thirds of Americans receiving at least one gift card in 2023.

Traditional Gift Card systems have long been a familiar part of American culture. They are quick, convenient, and make for an easy gifting choice across generations and occasions. Whether for birthdays, holidays, or last-minute celebrations, gift cards often represent a thoughtful yet practical gesture.

But as digital payment ecosystems evolve, a question emerges: Are traditional gift cards still serving consumers effectively?

This analysis examines the traditional strengths and growing limitations of gift cards and how OnestPay™ defines the shift in prepaid gifting concept of modern economy.

Popularity of Traditional Gift Cards

Gift cards have been part of mainstream retail for more than two decades. Their popularity stems from their convenience and simplicity. Consumers can buy them instantly, with no credit checks or added fees, and use them across thousands of stores.

Nearly every major retailer in the U.S. — from Target and Walmart to Macy’s, Ulta, and CVS — offers its own branded card program.

Industry data highlights their widespread use.

- Each year, American households purchase an average of 8 to 10 gift cards for various occasions.

- Nationally, the market is estimated at nearly $200 billion annually, reflecting its deep integration into retail spending habits.

For consumers, a Traditional Gift Card solves a practical problem. They eliminate the uncertainty of choosing the “perfect gift” and fit neatly into both in-store and digital shopping experiences.

However, why Traditional Gift Cards are a bad idea becomes clear when you compare them to a multi-merchant digital prepaid platform like OnestPay™ .

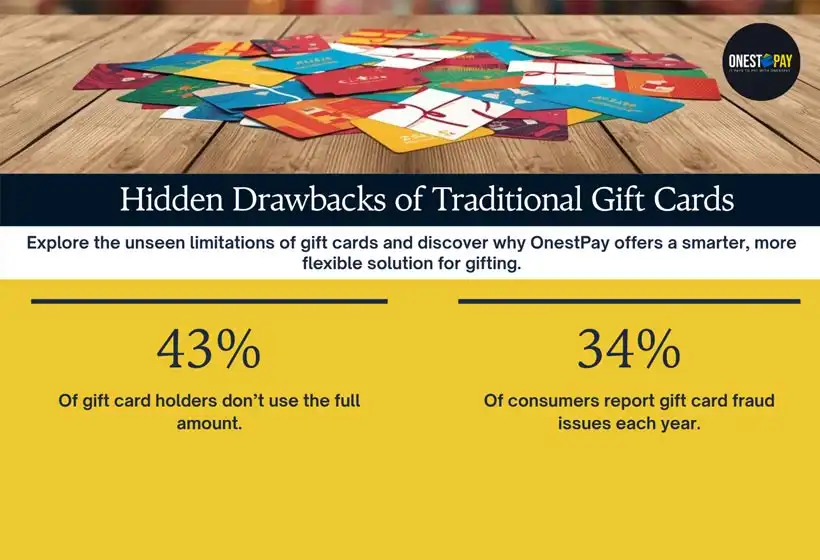

Hidden Drawbacks of Traditional Gift Cards

- Limited Use and Single-Purpose Value

Most Traditional Gift Cards are tied to a single merchant or brand. While this exclusivity benefits retailers by encouraging in-store spending, it restricts flexibility for recipients.

A card from a store the recipient rarely visits often ends up unused. Over time, billions of dollars in card value remain unspent each year because users simply forget about them or lose physical cards.

This is one of the biggest single-purpose gift card limitations today. Gift cards are designed primarily for gifting, not everyday transactions. Once the gifting moment passes, their utility declines.

- Security and Fraud Risks

Another major concern is fraud. Reports in recent years show a steady increase in scams involving Traditional Gift Cards, particularly targeting older adults. Fraudsters frequently convince victims to purchase high-value cards and share the codes, leaving little chance of recovery once the funds are redeemed.

The Federal Trade Commission notes that once money is loaded onto a Traditional Gift Cards, it is nearly impossible to trace or reclaim if compromised. Similar findings from consumer investigations show that even legitimate disputes rarely result in refunds, as most issuers lack a transparent recovery process.

- Physical Dependence and Inactivity

Traditional cards also rely on physical storage and user memory. Many consumers forget about their cards until long after purchase — often when they no longer fit into active spending habits.

Unlike prepaid digital wallet for everyday use, Traditional Gift Cards offer no reminders or integration with daily financial tools. Once misplaced, the funds are effectively lost, emphasizing the need for a solution for lost or unused gift card money.

Smarter Alternative: Save Now, Buy Later

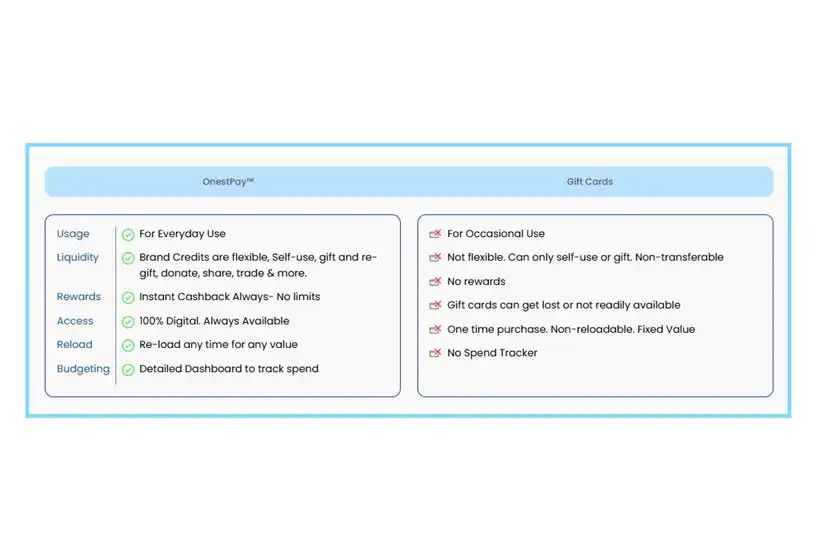

OnestPay™ enters this landscape as a response to these long-standing challenges. It retains the familiar benefit of prepaid value but expands it into a dynamic, flexible multi-merchant digital prepaid platform designed for both personal use and gifting.

At its core, OnestPay™ enables users to prepay participating merchants — more than 300 major retailers including Target, Walmart, Macy’s, Olive Garden, and leading grocery chains.

When users commit funds to a merchant in advance, they receive digital credits with no expiration date within their OnestPay™ wallet.

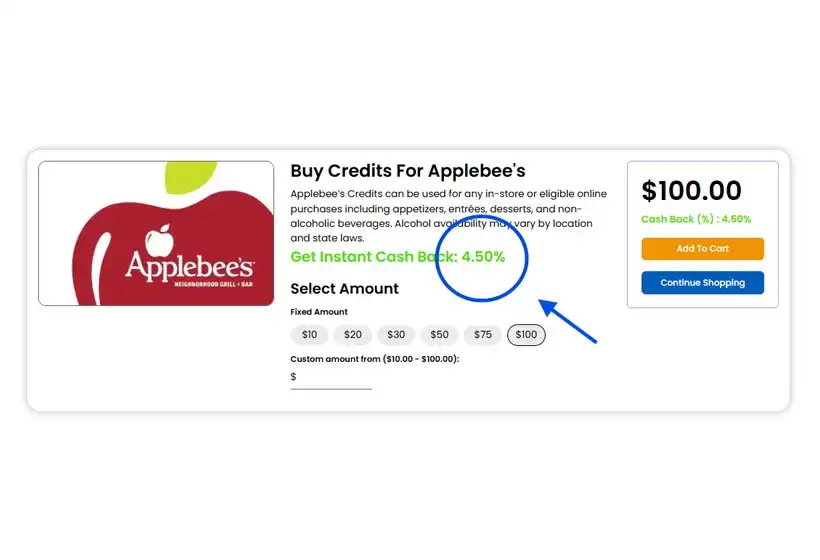

- Earning Instant Rewards

Unlike Traditional gift cards, this prepaid model generates immediate value. When a user prepays a merchant, the merchant reciprocates with instant cashback rewards, typically ranging from 1 % to 15 %, depending on the brand.

The result is a “save-now, buy-later” approach that combines the convenience of gift cards with the economics of cashback rewards. Consumers earn returns simply by committing to future purchases, while maintaining full control over how those credits are used.This approach maximizes Rewards & Value, making Traditional Gift Card vs OnestPay™ an easy debate to settle.

- Expanding Beyond Gifting

Whereas traditional gift cards are limited to just gifting, OnestPay™ credits are multi-purpose. They can be spent directly at participating merchants and gifted to friends or family. Users can split balances — using part for personal shopping and another portion for sharing — all within a single prepaid digital wallet for everyday use.

This flexibility extends the life and utility of prepaid value. If a recipient receives a gift they don’t prefer, they can easily swap the credit to another merchant they like— a true gift card alternative for swapping. The result is a more inclusive and adaptable system that suits individual spending habits rather than locking funds to a single brand.

- Digital Security and Accessibility

By design, OnestPay™ eliminates many of the security and usability issues associated with physical or Traditional Gift Cards. All credits are stored digitally within a secure wallet, reducing risks of loss or theft. Because the system operates through verified digital channels, digital transactions are traceable and protected.

Users no longer need to keep track of plastic cards or printed codes. Their entire balance — including cashback, merchant credits, and transaction history — is visible in one place. This accessibility supports better budgeting, transparency, and peace of mind.

This accessibility supports better budgeting, transparency, and peace of mind. It’s the Traditional Gift Card vs OnestPay™ difference — reliability, safety, and total control.

Traditional Gift Card vs OnestPay™

How To Gift Through OnestPay™?

- Step 1: Buys a grocery + coffee + rideshare combo in one purchase.

- Step 2: Gets instant cashback; balances appear in Wallet.

- Step 3: Redeems in-store via QR; later gifts leftover coffee credits to a friend.

Each journey illustrates a simple truth: programmable, digital credits outperform traditional gift cards in every measurable way.

An Onest Takeaway!

Traditional Gift Card vs OnestPay™ is no longer a competition — it’s a transformation. OnestPay™ redefines prepaid value with Gifting Utility that fits modern life. It takes what works — the upfront payment model — and enhances it with real-time cashback, multi-merchant usability, and digital convenience.

It’s not merely a replacement for Traditional Gift Cards but a broader, more adaptive financial tool — a prepaid digital wallet for everyday use designed to secure your funds, prevent fraud, and deliver rewards that last.