OnestPay™ Merchant Credits | Simplify Big-Ticket Purchases

Unlock Big-Ticket Purchases with OnestPay™ Merchant Credit.

Ever dreamed of managing big-ticket purchases without drowning in credit card fees or exhausting your savings all at once? You’re going to love what OnestPay™ has in store.

We believe that payments should be smart, simple, and socially rewarding. And it all starts with one powerful feature—Merchant Credits.

So, let’s walk you through it.

Benefits of Easy Installments for Big-Ticket Purchases

Whether it’s furniture, appliances, jewelry, weddings, travel, or even Christmas shopping, OnestPay™ helps you manage high-value expenses with ease. Here is how:

Spread Out the Costs

Instead of paying all at once, you can split large payments into smaller ones. You can make convenient pre-scheduled installments. It is suitable for planning ahead without straining your wallet.

No Interest, No Stress

OnestPay™ installment plans are interest-free. That means no surprise charges, just transparent, simple payments.

Earn While You Pay

With every installment you make, you earn rewards and bonuses. These credits can be used for future purchases, giving you more value with every payment.

Exclusive Savings

By paying in advance through OnestPay™, you often get access to exclusive merchant deals, bonus offers, and discounts.

You’re not just making a purchase—you’re planning smarter, saving more, and spending wisely. OnestPay™ platform is built to be easy to navigate, giving you full control over your installment plans.

Let’s explore the power behind it all—Merchant Credits.

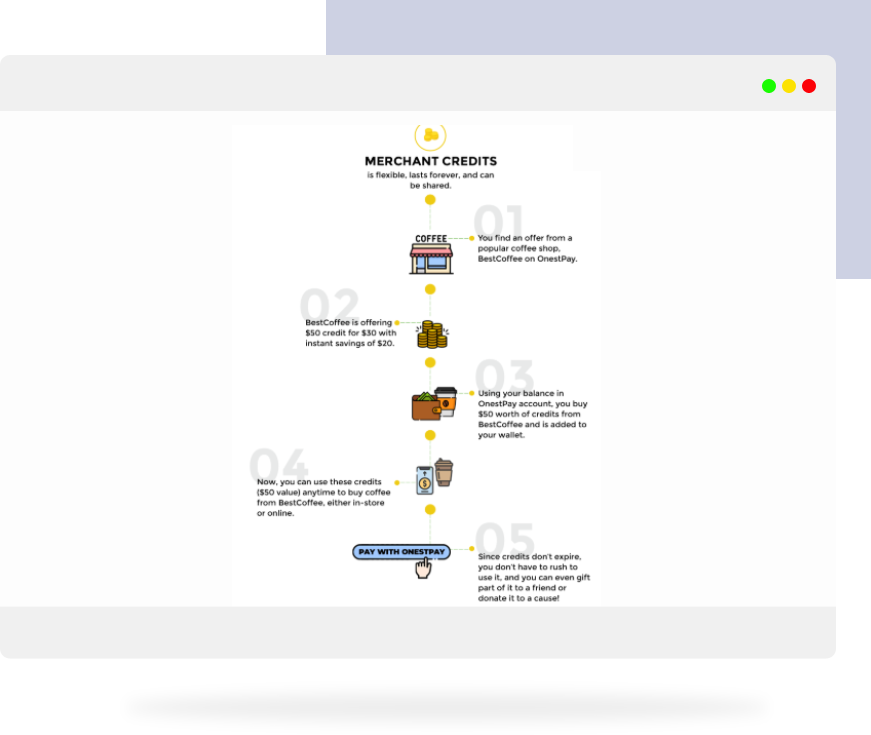

What Are Merchant Credits?

Merchant Credits are a smarter way to pay. When we talk about merchant credit, we’re talking about a universal payment tool that transforms the old-school “store credit” into something far more powerful, flexible, and rewarding.

You purchase credits—often at a discount—from your favorite merchants on the platform. These credits are then stored in your OnestPay™ wallet and can be used for future purchases.

The result? You get more for your money, more flexibility, and more control.

01 Why Merchant Credits Make Buying Big Things Easier?

Let’s break down the perks:

- Pay Less, Get More: Buy credits from merchants at a discount.

- Easy to Access: Buy deals directly through the OnestPay™ platform from trusted merchants.

- Instant Value: Once purchased, credits are instantly added to your wallet for future use.

- More Than Just Spending: You can share, gift, trade, or donate your credits to others.

With OnestPay™, it’s not just about spending—it’s about spending smart.

02 OnestPay™ vs. Other Payment Options

Here’s a comparison between OnestPay™ Merchant Credits and traditional payment methods like debit and credit cards.

- Funding Source & Spending Limit: OnestPay™ uses prepaid merchant credits. Debit cards draw from your bank, and credit cards use borrowed credit with varying limits.

- Savings & Interest: OnestPay™ offers instant discounts with zero interest. On the other hand, debit cards avoid interest, and credit cards charge interest if unpaid.

- Fees & Credit Check: Merchant Credits and debit cards have no fees or credit checks. While credit cards may have annual, late, or interest fees, and require a credit check.

- Rewards & Flexibility: OnestPay™ gives bonus credits, rewards, and multi-use flexibility (trade, gift, share). Debit cards offer minimal perks, and credit cards provide points or cashback.

- Behavioral Impact: Merchant Credits encourage mindful spending. While debit cards are neutral and credit cards may promote overspending.

OnestPay™ stands out with its focus on savings, rewards, and promoting mindful spending. It is a smart choice for managing big-ticket purchases.

Step-by-Step Guide: From Plan to Payment

Let’s walk through how you can fund your wallet and buy merchant credits on OnestPay™ for your next big purchase.

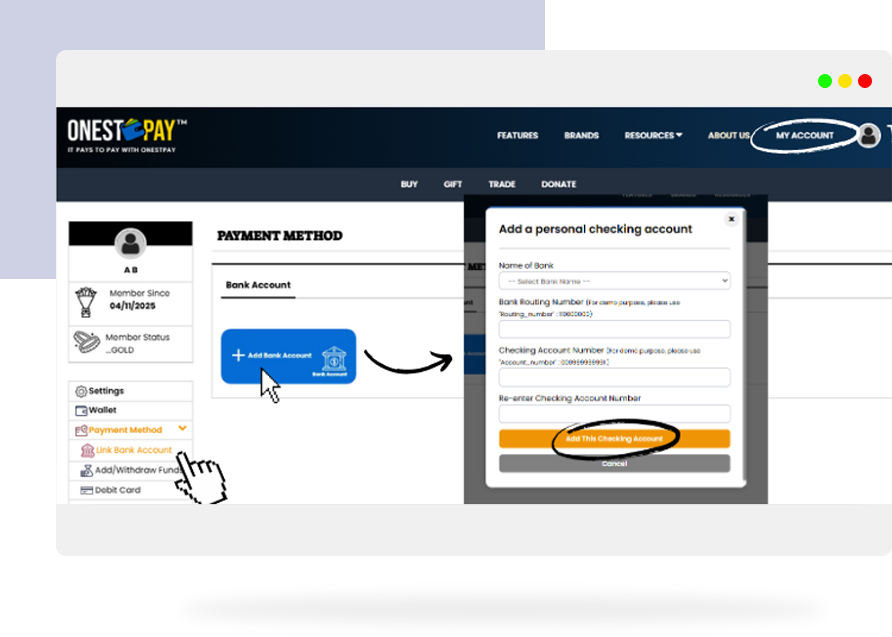

01 Link Your Bank Account

- Login to your OnestPay™ account

- Go to My Account

- On the left panel, click Payment Method

- Select Link Bank Account

- Click on Add Bank Account

Enter the required details:

- Name of Bank

- Bank Routing Number

- Account Number

Click Add Account

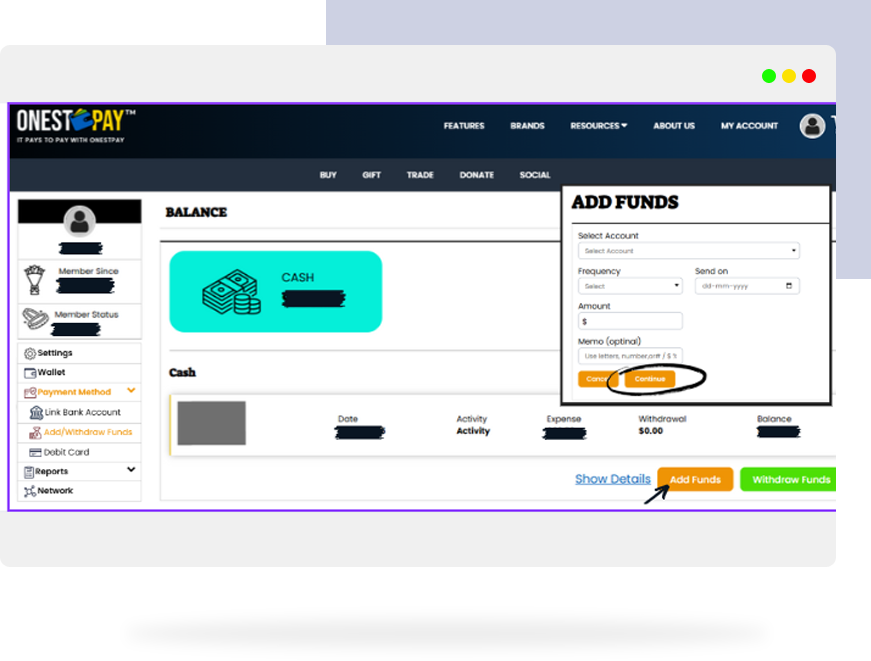

02 Add Funds to Your Wallet

In the same Payment Method section, click Add or Withdraw Funds

- Select Add Fund

A pop-up window opens—now set:

- Your linked account

- Frequency (One-time or recurring)

- Date

- Amount

Click ‘Continue’.

Carefully review all the details in the Review and Transfer window.

Click ‘Submit’ to proceed.

Pro Tip: Transfers cannot be canceled once submitted.

Congratulations—your wallet is funded!

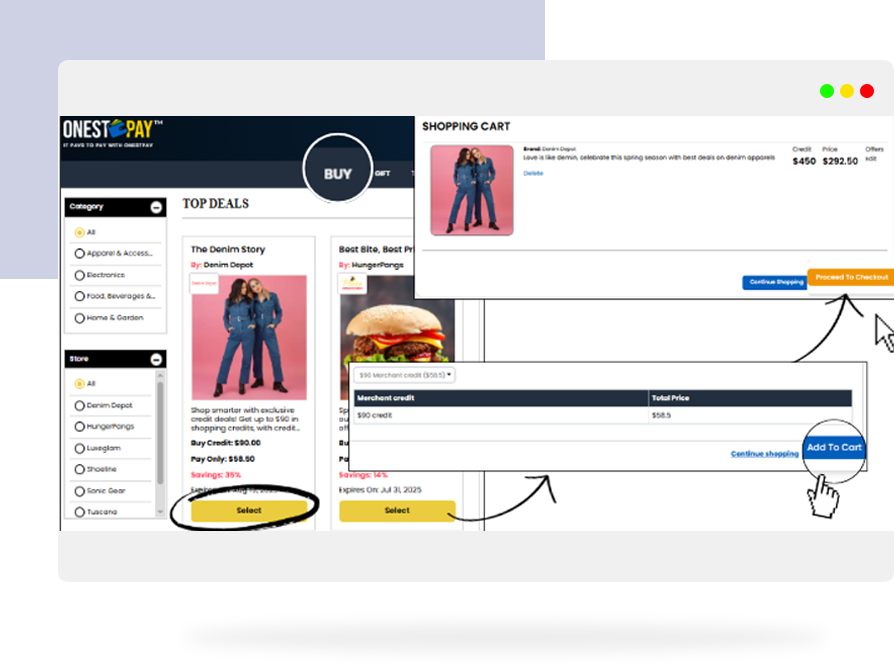

03 Buy Merchant Credits for Big-Ticket Items

- Head over to the Buy You’ll see top deals from verified merchants.

- Found a deal you like? Click Select.

- If you want to browse more deals, click on ‘Continue Shopping’. Otherwise, click on ‘Add to Cart’.

- Then you will be forwarded to the Shopping Cart. Click ‘Proceed to Checkout’.

That’s it—you’ve just locked in a deal, secured big savings, and taken a step toward smarter spending.

It’s Pay to Pay with OnestPay™

With OnestPay™, we don’t just help you pay—we help you plan better, save more, and get rewarded in the process.

Whether it’s for your home, your wedding, or your next big life event, Merchant Credits empower you to pay with intention and purpose.

So next time you’re planning a holiday escape, remember—you don’t need to swipe a card to make it happen. You just need a plan and OnestPay™.

Ready to Get Started?

Head to onestpay.com and sign up.